No Results Found

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

Phonetically speaking we know the two things that are guaranteed are death and taxes. However debt can be the precursor to death for not just companies, but industries. The ethanol industry, reading through the last 2 years of SEC filings by ADM, indicate that Ethanol has had a negative effect on their profits. In 2014 their bio-products profit decreased $69 million to a $120 million loss and interestingly in 2015 this segment operating profit was down a further 16%, due primarily to weaker ethanol margins and lower volumes. They also noted that processed volumes of corn were decreased in response to high ethanol industry production which outpaced demand throughout the year. This was on top of loss provisions of $45 million related to sugar ethanol facilities in Brazil. So easy to swallow up debt and allow for loss provisions when part of a corporation with the risk spread across multiple commodities.

Interestingly enough, the U.S. Energy Information Administration has released the April 2016 edition of its Short-Term Energy Outlook, predicting ethanol production this year will increase when compared to 2015 levels.

The ethanol market in the US is made up of 195 production facilities most of which are not part of large corporations. The 16-17 months in 2013-14 were bumper months for margins in the ethanol industry and those plants who paid down their debt are more likely to be able to manage a route through the current down turn in profit margins. However, in the middle size companies it can be more important to watch the debt to equity ratios far more than the stock prices. Margins are in the single digit percentages and are unlikely to increase at all this year. Subject to oil price continuing to remain low and volume remaining high this has a likelihood of continuing into 2017.

In contrast to the last 10 years there is an expected reduction in the export program where Europe are expected to maintain their tariff duties and balance their demand with adequate supplies. China too bears no favors to the industry where they are piling on the pain with anti-dumping tariffs for US DDG’s.

Turning over billions of dollars mean nothing more than being a large hamster going nowhere in a very big wheel if your profits are not there to service the debt. Nothing is guaranteed other than death and taxes, not even if it is a natural resource. Look at the coal industry. St. Louis-based coal producer Peabody Energy is the latest coal producer recently to file for bankruptcy. This follows Arch Coal, Alpha Natural Resources, Patriot Coal, and Walter Energy. Peabody’s used to have a market cap in excess of $20 billion just a few years ago. Debt in the oil industry also being a burden saw Energy XXI from a stock price of $32 to close recently at $0.12c.

The ethanol industry may not wish to acknowledge it but the RFS is only a mid-term support. Low oil prices, increased energy efficiencies in the car industry and heavy lobbying from the oil industry are unlikely to assist forcing any blend increase beyond the 10% wall. Over the last 10 years the industry has survived two dramatic drops in energy prices, though none as sustained as the current one. There is still some weeding out of the older generation plants and E85 is purely aspirational, no matter how many open letters from Governors and Senators are written. Diversification beyond ethanol and DDG’s is paramount to the survival and indeed longevity of the industry. Just squeezing 1-2% ethanol and DDG’s or corn oil is merely polishing the edges.

[TheChamp-FB-Comments style=”background-color:#f7f7f7;” title=”Leave a Comment”]

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

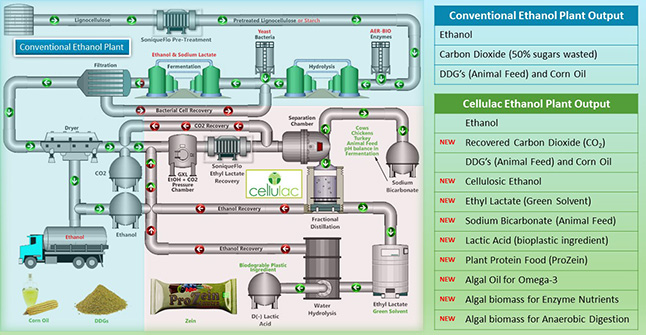

The ethanol industry has only been around for the last few of decades, though in its present state it takes centuries of fermentation knowledge to achieve the same output of ethyl alcohol (ethanol).Today, there are by-products or side-streams, such as distilled dried grains (DDG’s) for animal feed, corn oil and in many cases the recovery and re-use of CO2 for the food and beverage industry.

But, unless and until there is an efficient low-cost and low-energy conversion of 100% of the side streams into multiple high-value finished products, the ethanol industry with high-debt to equity ratios will be at risk of failure. Survival on low single EBITDA margins is not a success. It is deferring the inevitable slow drip demise of the industry, much like shale-oil.

The inefficiency lies in the low value of CO2 compared to the cost of processing 50% of the sugars that go through the fermentation process. Most of the CO2 is lost to the atmosphere. Likewise, the high energy consumption of drying the distilled wet grains to produce DDG’s reduces the efficiency of the refining process.

The only reason that 80% of the ethanol industry exists is down to the renewable fuel standard (RFS). It is the most efficient and cost-effective octane additive in the motor industry, but without the requirement to add a minimum of 10% to the gasoline in the tank it is unlikely that the oil industry, refineries, would see this industry as viable on the scale it currently produces at.

A high corn crush margin ethanol production plant would transform the industry. So much has been made of the need to diversify and reduce the reliance on ethanol alone. Developments such as DDG’s, Corn Oil and even CO2 go some way to achieve this goal. However, this is simply not enough to ensure a reasonable return on investment and cover investment needed to maintain and upgrade for future longevity of the industry.

The route to Cellulosic Ethanol is a long hard slog with the high cost of Capital Expenditure along with low sugar content of biomass and its higher cost of extraction. There is 60 to 65% by weight, dry matter of C5 and C6 sugars in corn stover and wheat straw. In principle the low cost of biomass, in this case, corn stover and/or wheat straw is viable. In practice, the cost to access and convert into ethanol is much higher because of the higher energy necessary to extricate the polysaccharides (sugars) from the corn stover. In addition, multiple types of sugars require multiple enzymes or enzyme cocktails in preparation for fermentation to ethanol and CO2.

Realistically, Cellulosic Ethanol is not likely to be commercial before 2020 at the earliest and most optimistic. It will be closer to 2025 by the time an overall solution is in place. Many a small fortune has been made, starting with a large fortune sunk into cellulosic ethanol.

It is not enough to incrementally increase the already tiny margins with single piece add-ons. Increasing the yield by changing an enzyme or bacteria or undertaking a long-term investment to add less than 10% to the crush margin still does not justify the loss of 50% of sugars to the atmosphere in the form of CO2.

The Cellulac solution goes beyond the ethanol industry and crosses into higher value biochemicals, biodegradable plastics, green solvents, microalgae and a combination of nutrient support, anaerobic digestion for biogas, recovery of thermally treated biomass as organic fertilizer.

Most importantly is getting the consumer behind an industry that is not wasteful, but beneficial to the economy, environment and the future energy of the planet.

[TheChamp-FB-Comments style=”background-color:#f7f7f7;” title=”Leave a Comment”]

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.