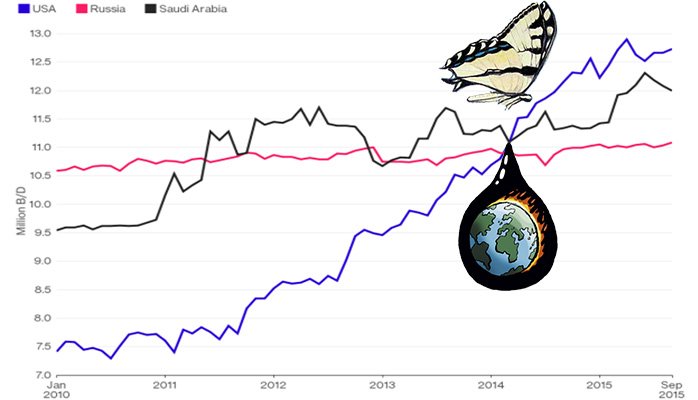

Butterfly Effect of Oil Price on Renewables

The butterfly effect is a concept that small causes can have large effects. Initially, it was used with weather prediction but later the term became a metaphor used in and out of science. Now it can easily be related to a single decision made by a Saudi Oil Minister.

Parallel Oil Worlds

I read articles on the bioeconomy referring constantly to the “need” to replace fossil fuels, sometimes in amazement, wondering if there are two parallel worlds. I listened to Saudi Oil Minister, Ali Ibrahim Al-Naimi, telling the world that the freezing of oil production at January 2015 levels is merely part of a process. The objective is to force U.S. high cost shale oil producers to shut down, even if Saudi have to produce at $20 per barrel. His direct comment: “It sounds harsh, and unfortunately it is, but it is the most efficient way to rebalance markets”.

Henri Colens, Public Affairs Manager, Renewable Chemicals, at Braskem Europe, mentioned in an interview with Il Bioeconomista that “we all need to work harder on raising public awareness, so that citizens understand what we are doing and the potential of the bioeconomy”.

Oil Power beats Citizen Power

The power of citizens it seems are over shadowed by the flapping of an oil ministers wings when it comes to the biochemical and biofuel market.

Saudi Arabia, Russia, Qatar and Venezuela proposed a freeze that would cap production at January levels. The same day Iran called the proposal for a freeze ridiculous as they began their production of 1 million barrels per day. When the price of oil collapsed to below $50 a barrel in March of 2015, Saudi Arabia and Iraq began to increase production. Since February 2015 Iraq and Saudi have increased production over 1.3 million barrels per day.

Butterfly cascade after one decision

The cost of oil reduces the cost of refining to gasoline which in turn is blended with ethanol. When it drops so low that ethanol is more expensive than gasoline production, demand falls and high cost producers of ethanol suffer serious margin erosion. Citizens are happy as pump prices are lower, but the butterfly effect starts to hit more than shale oil.

Sovereign wealth funds who amassed wealth while oil prices were higher would have invested in growth of the world economy. Now many of them, including Saudi Arabia, Norway and other oil producers are dipping into their funds to balance their fiscal budgets. Russia being one that is suffering on a number of levels with economic sanctions and low oil prices. This leaves little discretionary investment funds for the bioeconomy who are still far from sustainable profitable businesses, leaving little support other than State or Federal supports.

So far from cellulosic ethanol

In 2010-2011 of the five biofuel companies who listed on NASDAQ today only one is still focused on fuel and constantly diluting their shareholders while others are searching for lower volume, higher value added, biochemicals. The search for cellulosic ethanol sees pilot plants such as Abengoa Hugoton achieving costs of $4.55 a gallon of ethanol. Considering the oil price no wonder this has been closed.

The point is that biofuel, or indeed the bioeconomy overall, requires that oil prices are much higher just to survive, both to compete on price, but also to have profits in the petrochemical companies available for investment in these alternatives.

Is Petro-Biofuel hybrid evolution enough?

There are a few hybrids. Braskem, as mentioned above, and Croda International PLC who posted a 10% increase in pre-tax profits where they use 70% renewables such as palm oil to produce ingredients for cosmetics and paint. Although in existence since 1925, they are a good example of how renewables are a work in progress over a timeframe that requires the patience of an evolution rather than the desperation of a revolution. The question is whether the citizens of planet earth have the time to evolve from the oil wars to survive the climate change.

[TheChamp-FB-Comments style=”background-color:#f7f7f7;” title=”Leave a Comment”]

Consortium of Irish Biomedical companies in €3m joint venture to deliver biodegradable implants from 2nd generation biochemicals.

Three Irish biomedical companies Cellulac Limited, Venn Life Sciences Holdings Plc (“Venn”) (AIM: VENN) and Bipharmed West Limited today are pleased to announce a joint venture to pursue the development of biodegradable human implants. This consortium brings...

Irish Start-up Cellulac wins €2.8M from EU Commission for Biorefining Project.

EU grant to Cellulac indicates the high-commercial potential of their product - Sherlock Galway based Greentech company, Cellulac, has received a grant for a record €2.8m from the European Commission to commercialize its biorefining technology that converts...