Joining forces with Integumen for sales of Omega 3 and bioplastics

Today, Cellulac announces that it has signed Heads of Terms to enter into a commercial technology agreement with Integumen (LSE: SKIN). In addition, Integumen has conditionally agreed to acquire 9.35% of the issued shares of Cellulac. Gerard Brandon and Camillus Glover, Chief Executive Officer and Chief of Operations of Cellulac respectively, will join the Board of Integumen and take up management in parallel roles to those held in Cellulac.

Gerard Brandon (Chairman & CEO of Cellulac) commented:

“Cellulac has novel technology and IP with commercial traction. The marriage of this technology and Integumen’s consumer presence online and in other retailers will create a supply source to customer supply chain of natural oils and biodegradable plastic ingredients to a number of sectors.

The environmental impact of single-use plastics is well documented and increasing awareness of the harm it is causing to our planet has driven governments, companies, and individuals to abandon the use of these materials and seek alternative solutions. We believe we are strongly placed to provide an effective and more eco-friendly solution.”

Tony Richardson (Chairman of Integumen) commented:

“The Board acknowledges the challenges Integumen has faced in generating returns for shareholders. We have been working hard to identify the best route forward and we believe acquiring a stake in Cellulac presents a number of opportunities to accelerate revenue generation. The economic and environmental drivers of biodegradable plastics are compelling driven by the global attitudinal shift against single-use plastics, creating strong potential demand for Cellulac’s products. We believe the actions we are taking will position us well for the future.

The wealth of experience and expertise that Gerard Brandon and Camillus Glover bring to their respective new roles of Chief Executive Officer and Chief Operations Officer at Integumen, I believe, will see accelerated growth across the business.”

Full details of the announcement can be seen on the London Stock Exchange website here

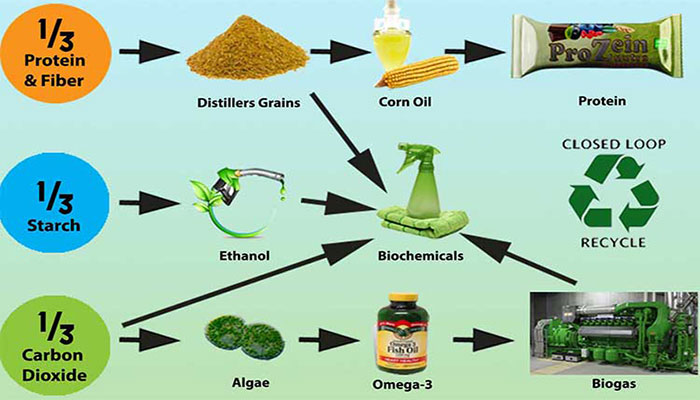

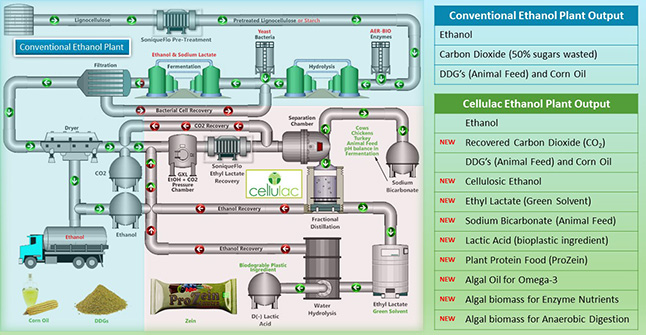

Extracting real value from the Ethanol Industry

Hybrid Solutions There is no need to reinvent a billion dollar wheel of bio-industrial experimental development. True value can be extracted and integrated as hybrid synergistic solutions from the best-in-class of what already exists. Over the last 10...

Have we Reached Peak Biofuel?

Is there really an energy security risk? Former NATO Secretary General Anders Fogh Rasmussen is calling on Europe to increase the production of biofuels from an energy security perspective because of geopolitical risks. This is a tough ask if such increase in...

Biofuels Perfect Storm

Biofuels Perfect Storm Since August 2015, ethanol has traded at a premium to gasoline which is unusual by historical standards. This is likely to continue until oil prices rebound into the $45-50 per barrel range. Even with this situation, 2015 ethanol...

Ethanol Industry is not too big to Fail

Phonetically speaking we know the two things that are guaranteed are death and taxes. However debt can be the precursor to death for not just companies, but industries. The ethanol industry, reading through the last 2 years of SEC filings by ADM, indicate that...

High Corn Crush Margin Ethanol Plant Solution

The ethanol industry has only been around for the last few of decades, though in its present state it takes centuries of fermentation knowledge to achieve the same output of ethyl alcohol (ethanol).Today, there are by-products or side-streams, such as distilled...

Corny Problem for EU Sugar Producers

The abolition of sugar quotas in 2017 will have such a profound effect on EU sugar producers, used to super profits under the EU supported Common Agricultural Policy (CAP), that many smaller producers will be subject to consolidation or have to cease...