Corny Problem for EU Sugar Industry

The abolition of sugar quotas in 2017 will have such a profound effect on EU sugar producers, used to super profits under the EU supported Common Agricultural Policy (CAP), that many smaller producers will be subject to consolidation or have to cease production. The problem will not be due to the increase in sugar production from EU countries that were subsidised for not producing during the quota period but due to a greater threat from a restricted sweetener that is up to 30% cheaper to produce.

In 2017 Isoglucose or high fructose corn syrup also known as glucose-fructose will have its quota restriction lifted within the EU. Isoglucose is mostly made from corn but can be made with wheat.

In the United State Isoglucose is used as a sweetener by up to 50% of the sweetener market. Japan uses it for 20% of their sweetener ingredients. Because of the quota the market share in the EU was only 5% in 2013.

It will not take much to see a rapid substitution of sugar for Isoglucose in soft drinks, bakery products, jellies, canned fruits and dairy products. This amounts to a realistic market transition of about 30% of industrial sugar consuming companies that now use sugar as a sweetener.

If Isoglucose were to reach such drastic adoption then it is likely that sugar surpluses will increase and EU sugar prices will come under extreme pressures. If tariffs stay in place, which is doubtful considering the recent agreement on TTIP trade between the US and EU, the EU farming community may survive, but only for a short time as Isoglucose produced within the EU from 2017 will eventually force substitution anyway.

Cereals prices remain under pressure from abundant world supply, slow demand and mostly good prospects for new crops. The cost of production of Isoglucose, net of raw materials is around $200 (€180) per ton leading to a finished price of $370 (€337) per ton. Compared to the current EU import price of sugar at $529 (€482) per ton, Isoglucose would represent a potentially large export market for US based ethanol producers.

Ultimately it will mean EU sugar producers who wish to keep market share will have to drop their prices by up to 30%.

[TheChamp-FB-Comments style=”background-color:#f7f7f7;” title=”Leave a Comment”]

Integumen License Ageement

Today, Cellulac announces that it has signed Heads of Terms to enter into a commercial technology agreement with Integumen (LSE: SKIN). In addition, Integumen has conditionally agreed to acquire 9.35% of the issued shares of Cellulac. Gerard Brandon and Camillus...

What are you doing about ocean pollution?

To many people watching Sky News and their #OceanFree Campaign, you would think that removing plastic from the oceans will be enough to resolve the problem. Sadly, this is not the case. The oceans ability to provide food from fisheries and aquaculture is...

Climate Change Our Bit Infographic

[TheChamp-FB-Comments style="background-color:#f7f7f7;" title="Leave a Comment"]

Biomassive Revolution

It's just not your fault What if I were to tell you that it is not your fault that the seas are polluted with plastic that the fish and whales are consuming? In the same way, I can say that it is not your fault that over-fishing is destroying future fish...

Daring to Dream Big

The definition of insanity is doing the same thing over and over again and expecting a different result - Albert Einstein Another 300 million tonnes of plastic every year Since World War II we have consumed 5 billion tonnes of plastic, much of which has ended...

Low Energy Microalgae to Biofuel at Commercial Scale

Food and Fuel for the 21st Century Microalgae have come to the attention of the industrial and academic community over recent years because of their ability to harvest the energy of the sun and provide valuable molecules that offer great potential to provide...

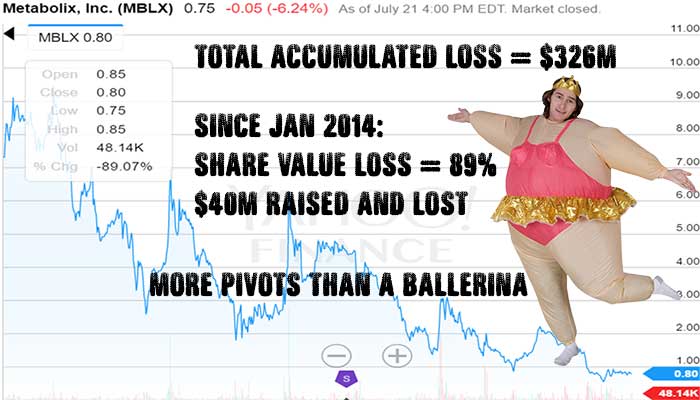

Cellulac Formally Requests Metabolix Shareholders to Consider Merger Proposal

Cellulac merger proposal to Metabolix worth $40m in assets and offtake agreement of $38m rejected in favor of closing biopolymer business and spending $35m over 7 years on crop science project with no revenue. DEAR METABOLIX SHAREHOLDERS London, UK. 25th...

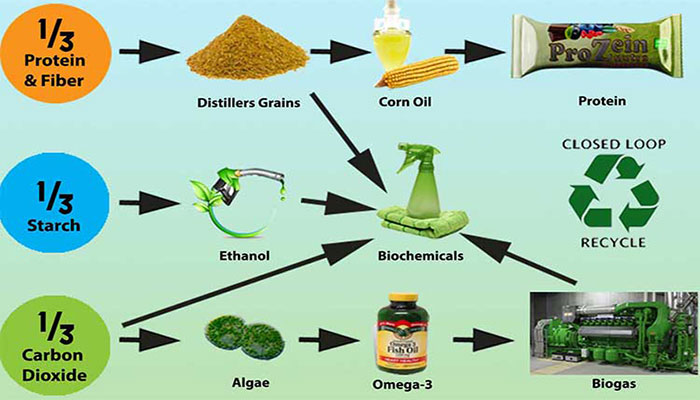

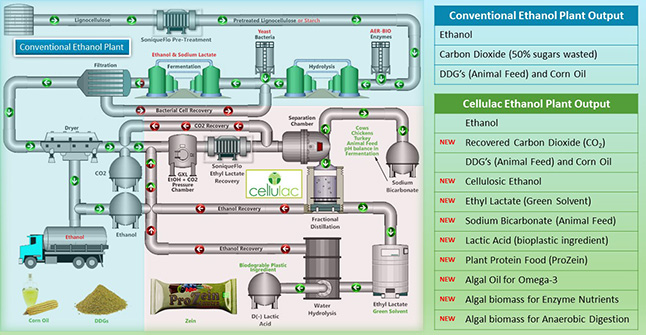

Extracting real value from the Ethanol Industry

Hybrid Solutions There is no need to reinvent a billion dollar wheel of bio-industrial experimental development. True value can be extracted and integrated as hybrid synergistic solutions from the best-in-class of what already exists. Over the last 10...

Have we Reached Peak Biofuel?

Is there really an energy security risk? Former NATO Secretary General Anders Fogh Rasmussen is calling on Europe to increase the production of biofuels from an energy security perspective because of geopolitical risks. This is a tough ask if such increase in...

Biofuels Perfect Storm

Biofuels Perfect Storm Since August 2015, ethanol has traded at a premium to gasoline which is unusual by historical standards. This is likely to continue until oil prices rebound into the $45-50 per barrel range. Even with this situation, 2015 ethanol...

Ethanol Industry is not too big to Fail

Phonetically speaking we know the two things that are guaranteed are death and taxes. However debt can be the precursor to death for not just companies, but industries. The ethanol industry, reading through the last 2 years of SEC filings by ADM, indicate that...

High Corn Crush Margin Ethanol Plant Solution

The ethanol industry has only been around for the last few of decades, though in its present state it takes centuries of fermentation knowledge to achieve the same output of ethyl alcohol (ethanol).Today, there are by-products or side-streams, such as distilled...

Big Oil Can’t Alter Climate Change

In a recent major MIT Study (Covert, Thomas, Michael Greenstone, and Christopher R. Knittel. 2016. "Will We Ever Stop Using Fossil Fuels?" Journal of Economic Perspectives, 30(1): 117-38. ) it was shown that approximately 65 percent of global greenhouse gas...

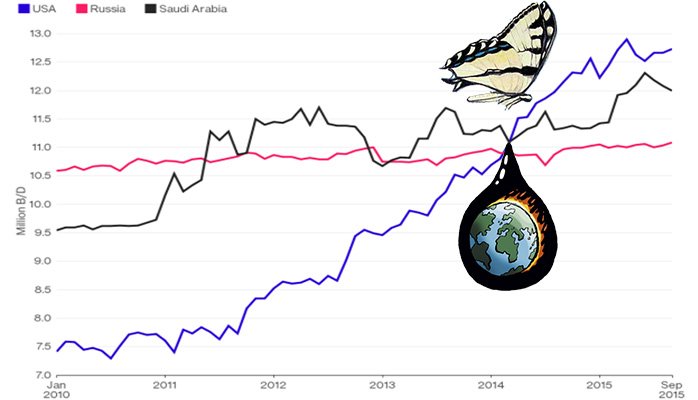

Butterfly Effect of Oil Price on Renewables

The butterfly effect is a concept that small causes can have large effects. Initially, it was used with weather prediction but later the term became a metaphor used in and out of science. Now it can easily be related to a single decision made by a Saudi Oil...

Cellulac Acquires Aer Sustainable Energy (Aer-Bio)

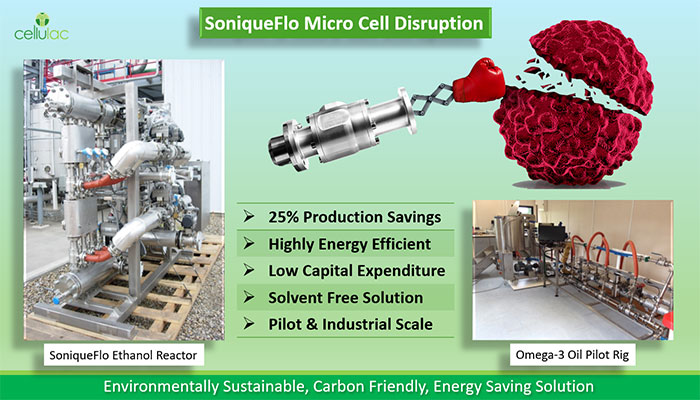

10 fold saving in enzymes, 4 fold increase in algae oils within 2 hours reducing the process costs of Omega-3, animal feed and biofuels Dublin, Ireland, 18th May 2015: Cellulac, the industrial biochemicals company, today announces the acquisition of Aer...

5 year, €35m Pharmafilter Partnership with Cellulac

Partnership delivers 2nd generation bioplastics supply chain solution for hospitals Dundalk, Ireland and Amsterdam, The Netherlands, 30th March 2015: Cellulac, the industrial biochemicals company, and Pharmafilter, a provider of integrated waste management...

Lactic Acid from Lactose Whey in World First Continuous Production runs

Cambridge, UK. 19 May 2014: Cellulac, the industrial biochemicals company is delighted to announce the world’s first ever industrial level continuous production of lactic acid from deproteinized lactose whey. Our 10 day production run concluded this week and...

Cellulac to Acquire Patent Portfolio and Industrial Biochemical Equipment from Pursuit Dynamics PLC

Cellulac Limited, the industrial biochemicals company, announces the acquisition of Pursuit Marine Drive Limited, a subsidiary of Pursuit Dynamics PLC, subject to shareholder approval. The acquisition includes certain intellectual property rights, test...