Cellulac Formally Requests Metabolix Shareholders to Consider Merger

Cellulac merger proposal to Metabolix worth $40m in assets and offtake agreement of $38m rejected in favor of closing biopolymer business and spending $35m over 7 years on crop science project with no revenue.

DEAR METABOLIX SHAREHOLDERS

London, UK. 25th July, 2016: Cellulac plc (@cellulac), is an industrial biochemicals investment technology company. Cellulac have been interested in Metabolix Inc., ($MBLX) for some time and after their announcement, in May 2016, of a strategic review, Cellulac made a formal proposal via the CEO to merge both companies. The proposal meant Cellulac would contribute industrial scale production assets with biochemical and biopolymer capacity, independently valued at up to $40m. In addition, terms for a manufacturers licensing agreement of the combined Metabolix and Cellulac biopolymer assets with access to debt and equity funding from Cellulac assets and shareholders for a commercially focused growth strategy of the enlarged entity.

The Board of Directors of Metabolix decided the $40m merger offer was not important enough to inform shareholders

A merger with Cellulac, based on the biopolymer intellectual property and associated institutional knowledge, would reduce Metabolix development overhead to a more manageable level where manufacturing license fees and future royalties would transform Metabolix, for the first time in 24 years, into a profitable part of an enlarged bio-based company. Synergies would contribute shared management and development costs across a larger corporate group, multiple revenue streams comprising of production equipment installations, recurring revenue from biochemical production, manufacturing product licensing agreements, process licensing with biopolymer offtake agreements worth $38m already in place.

Right up to July 2016, Metabolix continued to burn $2m a month. This was no surprise considering the content of the presentation at the Roth Investor Conference on the 15th March 2016 and reiterated in the year-end report later that month.

March 29th Metabolix conference call to investors the CEO stated:

“Looking ahead the company is turning its attention to the next step, moving from commercial pilot-scale operations to a commercial-scale specialties business”.

Yet within 7 weeks Metabolix had sold the exclusive global rights and future royalties on PHA use in medical devices for the price of less than one month’s burn rate.

Astonishingly, after wasting 2 months and what appears to be a further $4m in costs, the Metabolix Board declined the Cellulac merger offer.

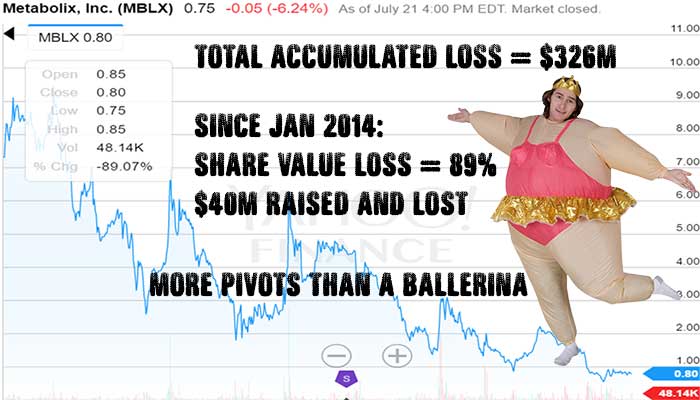

The Board of Metabolix has been responsible for:

- The supervision, over 24 years, of $326m invested by shareholders in biopolymer research and development

- Appointing the current CEO in January 2014

- Raising and overseeing the current CEO spend $40m on the biopolymer business

- Presiding over an 89% drop in shareholder value in the last 30 months; and

- A 99% drop from all-time high

The same Board has now decided to:

- Write off the entire biopolymer business

- Dismiss 48 people relating to the biopolymer business

- Pursue a path of further shareholder value destruction in questionable scientific research for the next 7 years as a public company.

In a written note a former Metabolix Senior Scientist said:

In the case of PHA producing plants the PHA content in one leaf could not represent the low overall content of PHA in the biomass. Many public presentations were not telling the exact picture, but rather the ‘nice numbers’. As a scientist I always challenged this phenomena. The plant project today is on the table for rapid growing biomass. But knowing the rate limiting factors in growing plants it will not solve the world problems…

Cellulac Core Terms

- Cellulac merge on a 50/50% share for share basis with Metabolix

- The immediate cessation of the current business model of Metabolix avoiding further unnecessary expenditure

- The restructuring/divestment of the high R&D overhead and associated costs of Metabolix

- The business model focused on the commercial activities at the core of Cellulac technology

- Metabolix is renamed Cellulac to indicate a change of business model away from the R&D to a commercially focused Company

Questions for the Board

I have three questions for the Metabolix Board of directors:

- Why did you decline a merger proposal, without informing shareholders, valuing Metabolix in excess of $35m offering industrial scale biochemical and future biopolymer production capacity, access to asset backed debt and equity funding for commercial growth delivering multiple revenue streams from a combined technology platform that would make Metabolix a profitable contributor of the enlarged corporate entity?

- Was there a Board decision in May 2016 to close the biopolymer business when the Board signed off on the sale of patents for the exclusive global use of PHA in the high margin medical device sector for $2m, and if so, why was management allowed to burn through another $4m until the end of July 2016?

- Why are you willing to subject shareholders to 7 more years of equity value destruction by dilution, at $5m costs a year, with no foreseeable revenues, in an early stage research and development project, other than for survival with access to government grants?

In Closing

In my opinion, by declining the offer from Cellulac, current management and Metabolix Board demonstrate a complete lack of business acumen or commercial vision. Displaying utter contempt for shareholder value they are adopting a strategy that requires investment of $35m over the next 7 years leading to further destruction in equity value with no visibility of revenue, other than government grants.

It is incumbent upon the Board members, but especially Independent Directors, majority and minority shareholders to immediately review the reasons for this illogical decision and become vocal about Cellulacs’ offer that adds $40m in biochemical and biopolymer assets for commercial scale production and manufacturer licensing and offtake agreements. This is likely to be the last opportunity to transform Metabolix, a 24 year loss making company, into part of a high growth enlarged group with multiple revenue streams for biochemicals and biopolymers, which would be cash generative this year.

Gerard Brandon

Chief Executive

Address

Registered Office

Finsgate, 5-7 Cranwood Street, London EC1V 9LH

Call us from UK +44 (122) 392 6660

Call us from US +1 (310) 421 2910

NOTES TO EDITORS:

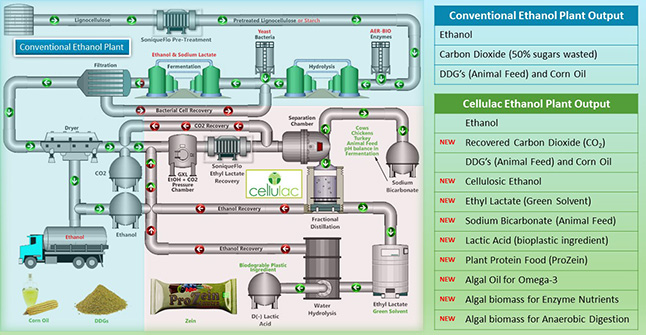

Cellulac is an industrial biochemicals investment technology company that collaborates with, and acquires, companies to exploit the combined production, intellectual property assets and institutional knowledge. We out-license non-core technology and expertise in exclusive and non-exclusive agreements, while at the same time, developing and extracting maximum value from the remaining core production and intellectual property assets that we acquire.

We seek to identify enzyme, bacteria, chemical process, fluid dynamic, electrical and software engineering efficiency opportunities within the bio-industrial technology sector that offer management synergies and hybrid integration and value added benefits to our existing technology platform. Such various technology combinations deliver valuable additions to production processes, improving margins and reducing costs in the bio-fuel and bio-chemical sector.

[TheChamp-FB-Comments style=”background-color:#f7f7f7;” title=”Leave a Comment”]

Integumen License Ageement

Today, Cellulac announces that it has signed Heads of Terms to enter into a commercial technology agreement with Integumen (LSE: SKIN). In addition, Integumen has conditionally agreed to acquire 9.35% of the issued shares of Cellulac. Gerard Brandon and Camillus...

What are you doing about ocean pollution?

To many people watching Sky News and their #OceanFree Campaign, you would think that removing plastic from the oceans will be enough to resolve the problem. Sadly, this is not the case. The oceans ability to provide food from fisheries and aquaculture is...

Climate Change Our Bit Infographic

[TheChamp-FB-Comments style="background-color:#f7f7f7;" title="Leave a Comment"]

Biomassive Revolution

It's just not your fault What if I were to tell you that it is not your fault that the seas are polluted with plastic that the fish and whales are consuming? In the same way, I can say that it is not your fault that over-fishing is destroying future fish...

Daring to Dream Big

The definition of insanity is doing the same thing over and over again and expecting a different result - Albert Einstein Another 300 million tonnes of plastic every year Since World War II we have consumed 5 billion tonnes of plastic, much of which has ended...

Low Energy Microalgae to Biofuel at Commercial Scale

Food and Fuel for the 21st Century Microalgae have come to the attention of the industrial and academic community over recent years because of their ability to harvest the energy of the sun and provide valuable molecules that offer great potential to provide...

Extracting real value from the Ethanol Industry

Hybrid Solutions There is no need to reinvent a billion dollar wheel of bio-industrial experimental development. True value can be extracted and integrated as hybrid synergistic solutions from the best-in-class of what already exists. Over the last 10...

Have we Reached Peak Biofuel?

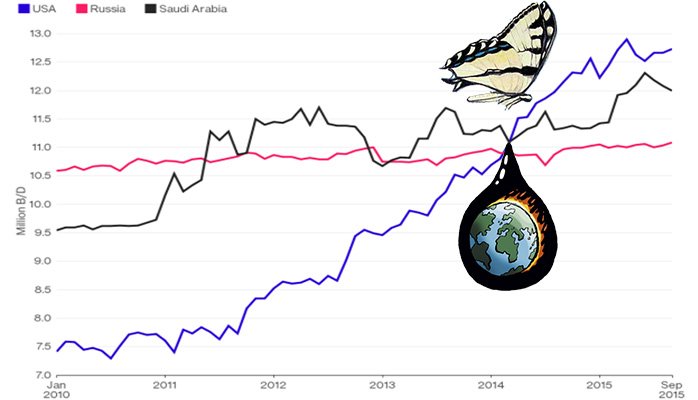

Is there really an energy security risk? Former NATO Secretary General Anders Fogh Rasmussen is calling on Europe to increase the production of biofuels from an energy security perspective because of geopolitical risks. This is a tough ask if such increase in...

Biofuels Perfect Storm

Biofuels Perfect Storm Since August 2015, ethanol has traded at a premium to gasoline which is unusual by historical standards. This is likely to continue until oil prices rebound into the $45-50 per barrel range. Even with this situation, 2015 ethanol...

Ethanol Industry is not too big to Fail

Phonetically speaking we know the two things that are guaranteed are death and taxes. However debt can be the precursor to death for not just companies, but industries. The ethanol industry, reading through the last 2 years of SEC filings by ADM, indicate that...

High Corn Crush Margin Ethanol Plant Solution

The ethanol industry has only been around for the last few of decades, though in its present state it takes centuries of fermentation knowledge to achieve the same output of ethyl alcohol (ethanol).Today, there are by-products or side-streams, such as distilled...

Corny Problem for EU Sugar Producers

The abolition of sugar quotas in 2017 will have such a profound effect on EU sugar producers, used to super profits under the EU supported Common Agricultural Policy (CAP), that many smaller producers will be subject to consolidation or have to cease...

Big Oil Can’t Alter Climate Change

In a recent major MIT Study (Covert, Thomas, Michael Greenstone, and Christopher R. Knittel. 2016. "Will We Ever Stop Using Fossil Fuels?" Journal of Economic Perspectives, 30(1): 117-38. ) it was shown that approximately 65 percent of global greenhouse gas...

Butterfly Effect of Oil Price on Renewables

The butterfly effect is a concept that small causes can have large effects. Initially, it was used with weather prediction but later the term became a metaphor used in and out of science. Now it can easily be related to a single decision made by a Saudi Oil...

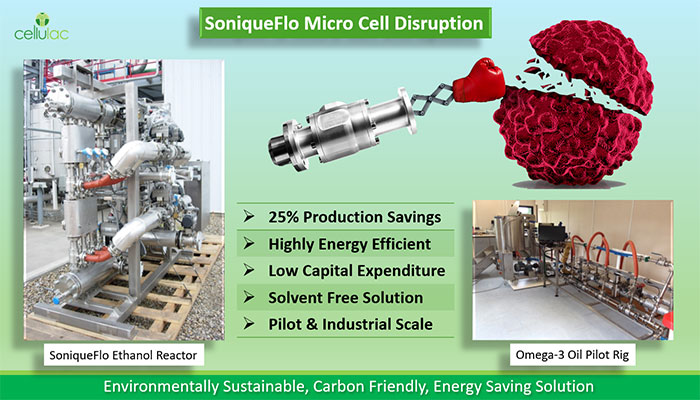

Cellulac Acquires Aer Sustainable Energy (Aer-Bio)

10 fold saving in enzymes, 4 fold increase in algae oils within 2 hours reducing the process costs of Omega-3, animal feed and biofuels Dublin, Ireland, 18th May 2015: Cellulac, the industrial biochemicals company, today announces the acquisition of Aer...

5 year, €35m Pharmafilter Partnership with Cellulac

Partnership delivers 2nd generation bioplastics supply chain solution for hospitals Dundalk, Ireland and Amsterdam, The Netherlands, 30th March 2015: Cellulac, the industrial biochemicals company, and Pharmafilter, a provider of integrated waste management...

Lactic Acid from Lactose Whey in World First Continuous Production runs

Cambridge, UK. 19 May 2014: Cellulac, the industrial biochemicals company is delighted to announce the world’s first ever industrial level continuous production of lactic acid from deproteinized lactose whey. Our 10 day production run concluded this week and...

Cellulac to Acquire Patent Portfolio and Industrial Biochemical Equipment from Pursuit Dynamics PLC

Cellulac Limited, the industrial biochemicals company, announces the acquisition of Pursuit Marine Drive Limited, a subsidiary of Pursuit Dynamics PLC, subject to shareholder approval. The acquisition includes certain intellectual property rights, test...